Venture capitalists are generally known for their optimism. However, this belief was shaken in April when COVID-19 forced startup investors to apply the brakes while investing.

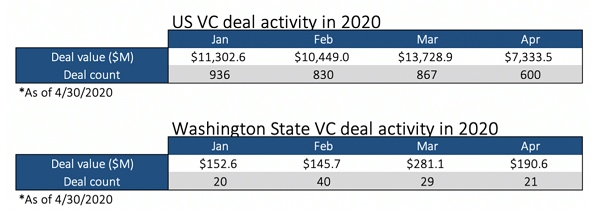

As the chart below shows, US venture capital investment fell a whopping 46% from March to April. National investment of $ 7.3 billion in April decreased 43% compared to April last year. The number of deals also slowed down to 600 deals in April. This corresponds to 867 deals in March and 1,060 deals in April 2019 according to PitchBook data.

National numbers confirm a recent report by the National Venture Capital Association that predicted a “bumpy ride” for startups looking to fund venture capital.

In Seattle and Washington, the picture was not that dark. In fact, the total in April – $ 190 million invested in 21 transactions – exceeded the months of January and February before the US coronavirus pandemic spread. Of course, it is difficult to identify trend lines from month to month with such a small sample size. However, a look behind Washington's April numbers suggests an interesting data point.

The three largest companies that have raised money in the past month – 98point6, Avalyn and Blaze Bioscience – are active in the health and life sciences sectors. Together, these three companies raised $ 101 million in Seattle, or more than half of the month.

Avalyn, led by well-known biotechnology entrepreneur Bruce Montgomery, develops therapies for severe respiratory diseases. 98point6 is developing new telemedicine products, and Fred Hutch's spin-out Blaze Bioscience is using a novel approach to brain tumor identification.

GeekWire's financing tracker for businesses in the Pacific Northwest, which includes companies in Washington, Oregon and British Columbia, has a relatively stable level of funding: USD 171.5 million was invested in 18 companies in April. This was a decrease from April 2019 ($ 265 million) but before April 2018 ($ 100 million). It was also declining compared to February and March this year, but rose slightly compared to January.

The challenge is probably ahead. It is unclear how many companies wanted to sign financing agreements quickly in March and April as funding sources would dry up in the coming months. Some investors may also switch to triage mode to reduce losses for startups that don't have traction yet, and to double the startups that are gaining momentum.

As the chart above shows, massive amounts of money went to startups in the Pacific Northwest in the second half of 2019. Given the current economic situation, it is unlikely that these values will be reached.

As we wrote in the past, COVID-19 does not treat all industries or companies equally. While travel-dependent companies like Rover and Airbnb are cutting staff, the disruption offers tremendous opportunities for a variety of other companies that see a faster switch to digital offerings, telehealth services, online education products, or medical innovations.

Venture capitalist Bill Gurley summarized this feeling and replied to a Recode history titled "The layoffs at Airbnb cast a dark shadow over Silicon Valley."

"Dark shadow over Silicon Valley" is inaccurate. In contrast to 2001 and 2009, this pandemic has so far hit only a few sectors extremely hard, and just as many companies see an improvement in their results (Zoom, Discord, Nextdoor). The real dark shadow lies over SMEs across America, not S.V. https://t.co/0ha3mp3oT0

– Bill Gurley (@bgurley) May 5, 2020